No matter what kind of a business person you are, there is one thing that we all have in common; you try and keep a close eye on the money. Without working capital in your personal or business life, everything tends to stop working right.

There are two great finance management tools I have encountered that have helped me spend less time on my finances by doing the following:

- quickly and easily watch where my money is being spent

- alert me of high spending/fraud

- give me a visual representation of where I am, financially

Why you want to use one of these services

- all of your finances at a glance

- spend less time on monitoring them

- easily determine where you need to cut spending

- be better enabled to save cash for a rainy day

- easily have your business expenses ready (and paperless) for tax time

What may turn you off

- worries about having all of your private information in one place

- having to log in every few days or once a week to make sure your transactions are categorized correctly

- being forced to be critical of your spending

- Mint has a clear consumer conversion agenda

- Yodlee is more involved than some may prefer

These are personal finance tools HOWEVER they are fantastic for small businesses and independent consultants (1099) to track their spending/income and run reports without business expenses included (Yodlee) if you prefer to see your real life cash flows without mixing in your expenses for work.

There are a number of these free personal finance solutions out there. The two that I found that make the most sense are Yodlee and Mint. Both are web-based, allow for budgeting, and automatically track transactions. These solutions work by you authorizing them access to your accounts – all of them. In case you are wondering, they are very safe and have MILLIONS of users between them. If you are not comfortable with this you should stop reading here as these solutions are not for you. For what it’s worth, they are as safe as your online bank or credit card and MUCH safer than handing your credit card to a 16 year old kid behind the counter of your local pharmacy.

You log into either and give the program the credentials for every online loan (student or otherwise), college saving fund, credit card, bank , retirement and investment account. In Yodlee’s case you can put your frequent flyer/rewards and make use of their bill pay service as well.

The program will log in and, initially, scrapes all the data from all over your financial life and, moving forward, will monitor it for changes to the account.

What is the value?

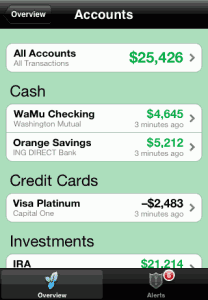

You can look at your entire financial picture at a glance. You can see what you have coming in and going out, see where ALL of your money is being spent, and forecast spending off of historical trends. Oh, and they both have mobile capabilities so you don’t need to download 10 different financial apps for your iPhone or Droid.

|

|

||

Mint

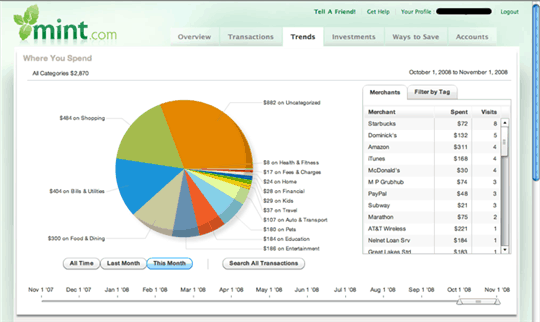

Mint has been out since 2005 and is now owned by Intuit. It has become really popular with people who are taking notice of their personal finances – and that number is growing. The site is aesthetically pleasing and the graphs are animated and snappy.

One great thing about Mint is that they have a blog where you can go and actually learn about your personal finances – as well as hear about new features of the service. It also offers a ‘free’ service of making suggestions of how you could save money by switching credit cards, bank accounts, investment services, IRAs, etc. This is actually their business model – affiliate links. They recently expanded their offering into financial planning tools.

Two criticisms I have about Mint are a) they tend to have issues from time to time with accessing your accounts. You are sometimes asked to reestablish access even if you have not changed anything in your accounts. And b) they require you to ‘split’ an individual transaction into two independent transactions if you need to categorize the parts differently. They are then no longer linked. Yodlee doesn’t suffer from this.

It’s hard to ignore that value this solution brings to it users. Not only do they go out and find you better deals on your financial services but they also attempt to educate the public about personal/business finance to enable them to make smarter decisions about money – something that is innovative in its own right.

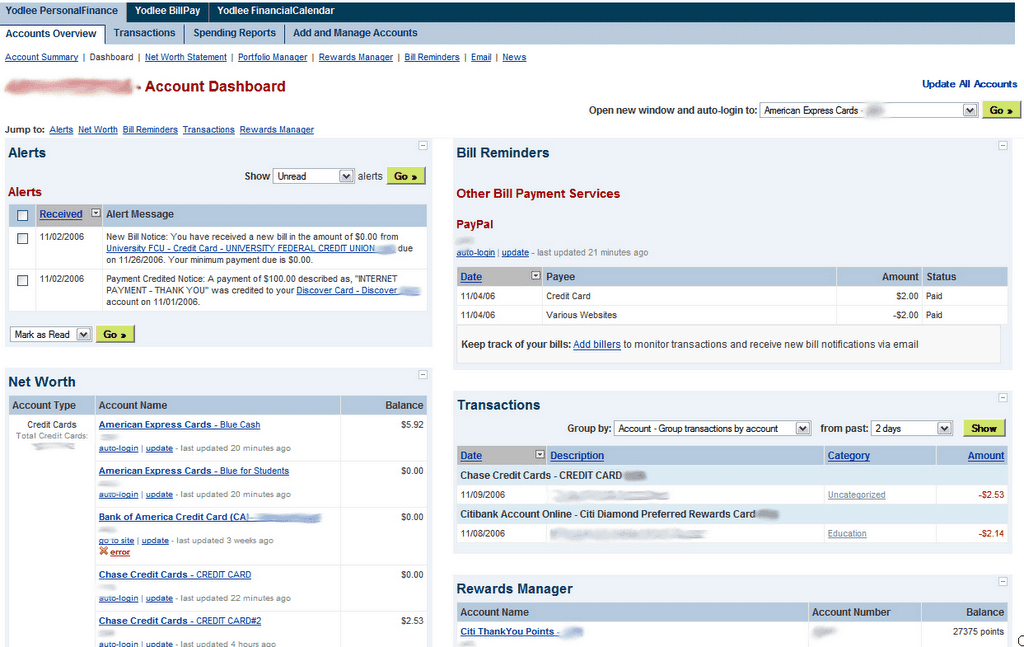

Yodlee

Yodlee has been around since at least 1997 (when I first started using them). While I use both of these programs, I tend to favor this one. While it isn’t nearly as ‘pretty’ and consumer friendly, the reporting is much more powerful and I like to use the Bill Pay feature. I also make use of the fraud alerts since I am a bit paranoid since having my identity stolen about ten years back.

Yodlee has been around since at least 1997 (when I first started using them). While I use both of these programs, I tend to favor this one. While it isn’t nearly as ‘pretty’ and consumer friendly, the reporting is much more powerful and I like to use the Bill Pay feature. I also make use of the fraud alerts since I am a bit paranoid since having my identity stolen about ten years back.

Something to mention is that Yodlee has a number of sides to their business, several institutional, so they do have more experience in the financial world. In fact, they power several private wealth/money management services in the financial services sector. This is how I first learned about it. This is a more serious solution than Mint. In fact, Yodlee used to power Mint for a long time so they are definitely the transaction aggregation authority.

A criticism of Yodlee you may have are that, as mentioned above, it’s not as sexy as Mint from a user experience standpoint and can sometimes seem a bit clunky. I feel that the extra features it offers more than make up for it. They still have a way to go in terms of mastering what graphs really are for consumers. They are trying to be more like Mint in that respect but, in my opinion, it’s not what they should be focused on. Here are my favorite features:

- Ability to ‘spit’ a transaction and categorize the separate parts. This comes in handy when you are splitting a bill or sharing an expense with someone who gives you cash for their half.

- You can easily tag transactions as ‘business’, ‘tax deductible’, ‘reimbursable’ and add a memo so you know what you spent the money on.

- Ability to run reports excluding the expenses mentioned in the last point. This will help you really understand what you are spending in real life vs. everything else.

- Excellent exporting ability. Those business expenses you just tagged can now be exported and given to your accountant for a big tax refund. No paper required.

- Budgeting and spending goals. Mint has this to, and in some ways it’s better, but you can have email and SMS alerts sent to you when your spending in a category approaches its threshold. NOTE: if the program categorizes the expense wrong, this could trigger false alerts.

- BillPay. Schedule a payment or pay all of your bills on one screen. Also easy to see what bills are due and when.

- Rewards Manager. Mint doesn’t have this feature at this time. I have around 20 air/hotel/rail/cashback/coupon accounts. To see them all on one page alone is worth using this tool.

Choosing either of these two solutions will definitely better your understanding of your financial picture. And that’s the point of this post. The challenging economic times we are living in, coupled with a consumerist mentality we have been instilled with over the past 50 years make learning about the value of money and tracking where it goes once it hits your pocketbook essential, in my opinion.

Do you use either of these services? Have I left out any feature you feel is a game changer for you? Share your thoughts.

-PH