Happy Thanksgiving from the Phacient team, wishing you and yours a very happy and healthily holiday. If you are not in the mood to cook, please make sure you go out and support your local restaurants. Days like today are important to the mom and pop eateries that really have an investment in your community. Give them your patronage and it will surely come back to you in some way. Also, please show your holiday spirit and generously tip your wait staff if you do so. Working on a day like today is tough on anyone – especially someone who really deserves to be waited on today for all that they do for others.

Happy Thanksgiving from the Phacient team, wishing you and yours a very happy and healthily holiday. If you are not in the mood to cook, please make sure you go out and support your local restaurants. Days like today are important to the mom and pop eateries that really have an investment in your community. Give them your patronage and it will surely come back to you in some way. Also, please show your holiday spirit and generously tip your wait staff if you do so. Working on a day like today is tough on anyone – especially someone who really deserves to be waited on today for all that they do for others.

Keeping yourself financially safe during the holidays

I haven’t posted anything in over a week so I figured a holiday wish along with a helpful, immediately useful tip, would be something nice for our readers. This one speaks to the idea of having a safe holiday – i.e., avoiding risk. If you are going to go out to dinner today – about 5% of Americans do – and, if you are like many, you will be using your credit card to pay for that delicious meal. That number is even higher if you look at the Tri-state area. Like it or not, credit cards are a part of our society and play a major role in the decision to spend vs. not. I received a letter from one of my credit card companies the other day. If you want to see the whole thing (along with my snarky remarks), it’s here.

I haven’t posted anything in over a week so I figured a holiday wish along with a helpful, immediately useful tip, would be something nice for our readers. This one speaks to the idea of having a safe holiday – i.e., avoiding risk. If you are going to go out to dinner today – about 5% of Americans do – and, if you are like many, you will be using your credit card to pay for that delicious meal. That number is even higher if you look at the Tri-state area. Like it or not, credit cards are a part of our society and play a major role in the decision to spend vs. not. I received a letter from one of my credit card companies the other day. If you want to see the whole thing (along with my snarky remarks), it’s here.

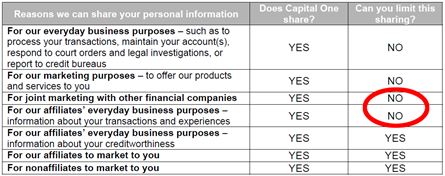

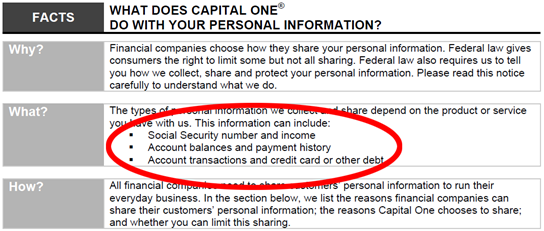

It’s a pretty standard privacy update to my credit card account. I get them all the time but for some reason I actually decided to read this one. A few things that made me rethink my relationship with this company:

Being a past victim of identity theft, I am a bit paranoid about certain information being shared with others. My social security number is one of them. My spending history is another. I understand that it’s necessary to share this information internally – but with outside entities? I’m not so OK with that. Fortunately, there is a way to opt out of this stuff with every company but…..

This company seems to not let you do that for things like internal marketing – I get this – and ‘affiliates’ everyday business purposes’. These are folks that this company does business with on a referral basis and will sell their customers’ info to other companies so that they can market to them. So Capital One is now telling Macy’s what I spend money on, how much, and when.

This company seems to not let you do that for things like internal marketing – I get this – and ‘affiliates’ everyday business purposes’. These are folks that this company does business with on a referral basis and will sell their customers’ info to other companies so that they can market to them. So Capital One is now telling Macy’s what I spend money on, how much, and when.

if I wanted Macy’s to know my spending habits I would shop at Macy’s. Like I mentioned earlier, I am a bit paranoid about others having information like this about me. And to be honest, I think most are. Everyone is entitled to their privacy. If the public is allowed to get aggravated and concerned about Facebook sharing your statuses and pictures with others I think my purchase of a LCD TV or baby food qualify as even more private.

I’m no lawyer but I am fairly certain that this is company policy and could easily be changed and not federal law that requires sharing this information in order for these two companies to do business. By this point in the letter I was already looking for someone to call and cancel my card – even if it could adversely affect my credit score.

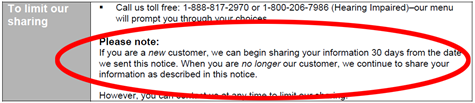

But upon further review, I discovered that after 30 days, Capital One will start to share my info with all of these different channels.  That’s no good for me because I have been a customer of theirs for years. The even more interesting thing is that if I cancel my card they will continue to share that information internally and with outside partners! Whoa, I am really not comfortable with this. Once I decide to discontinue my relationship with you I expect that the information sharing ends there. If I detect that I am getting spammed and riddled with junk mail because of my relationship with you, ending that relationship is intended to stop that spamming – from you and others – at the very least.

That’s no good for me because I have been a customer of theirs for years. The even more interesting thing is that if I cancel my card they will continue to share that information internally and with outside partners! Whoa, I am really not comfortable with this. Once I decide to discontinue my relationship with you I expect that the information sharing ends there. If I detect that I am getting spammed and riddled with junk mail because of my relationship with you, ending that relationship is intended to stop that spamming – from you and others – at the very least.

In this scenario, cancelling my account will not only potentially have an adverse effect my credit score, but you will distribute that now negative information to others. It doesn’t seem like there’s any way out of this loop.

Fortunately for me I haven’t used the card in years, partially because they have rubbed me the wrong way on some other fronts and, quite frankly, it’s just not a very good card. I have kept the card for credit purposes. We favor American Express because they let us opt out of whatever we like and their customers service is second to none. I don’t want this to turn into a post about me being an AMEX fanboy though so I will move on. ![]()

What does this mean for your business?

Well, there are a few things to keep an eye on with regard to this stuff. First, this affects your own personal credit as a small business owner. Adverse actions on your credit report WILL affect your credit and your ability to get personal loans for whatever reason you may need them. It would stink to need that $15,000 loan for new office computers just to be turned down because you are a few points too shy of meeting the cut.

Practices like the ones described will also clutter your inbox and mail box with marketing materials. If you are like me, you have no extra bandwidth in your day. An extra 15 emails or five extra direct mail pieces disguised a letter from a company you do business with ( = you WILL open these up to make sure there are no issues) steal valuable time from what you are trying to stay focused on.

Lastly, and most importantly, this will affect your customers’ spending habits – in two very important ways that will affect your bottom line:

- Consumers like myself will gravitate toward credit card companies that are more consumer-centric for their credit card needs. American Express is the gold standard here. And guess what, they are more expensive to process. The fees slide around but AMEX is roughly 100-150% more expensive for a vendor to accept than Visa or MasterCard. That means your credit card processing fees just doubled on that segment of customer – at the very least. And for those of you who have been in business for a while who have seen it enough times, people who use American Express are VERY loyal to American Express. I frequent very few places that don’t accept the card. So if you aren’t accepting it, you’d better be the best at what you do in your neighborhood or guys like me walk right on by.

- Secondly, and even more devastating, is that consumers are getting fed up with these types of practices. Customers that don’t want to deal with this issue at all will simply move back to cash. At first glance, this seems very appealing to a business owner however this has major MAJOR ramifications with regard to your bottom line. Credit cards allow people the convenience to live beyond their means and have funds on demand in the event that they haven’t been able to get to the ATM. No cash in their pocket at that moment means no sale – period. Do cash only businesses still exist? Of course. Do they thrive? Some. Do they claim every penny that goes across their registers? I, personally, doubt it. That translates into a whole different type of risk for the business owner.

I have a solution to this problem: change the information sharing practices of your credit card company – but that solution spawns all sorts of other financial challenges for these companies. Remember, they get paid to share your information with others. That keeps their rates lower and costs you as a business less. They won’t change their policies unless they are forced to. So, outside of that, I don’t have a solution. But that doesn’t make the issue any less real. And the more consumers get in tune with this, the more challenging things will get for the small business owner. If you have had any experiences with this or have a solution of your own, I gladly invite you to join the discussion.

-PH

Belated Happy Thanksgiving!!I am sure everyone enjoyed it a lot…